Overview

This a concept project exploring a personal budgeting app with a focus on future financial planning. I wanted to take my experience of business cash flow forecasting and financial modelling and apply the principles to personal finance. Particularly around scenario planning future cases based on the actions you take today and external factors that could impact you in future.

Market research

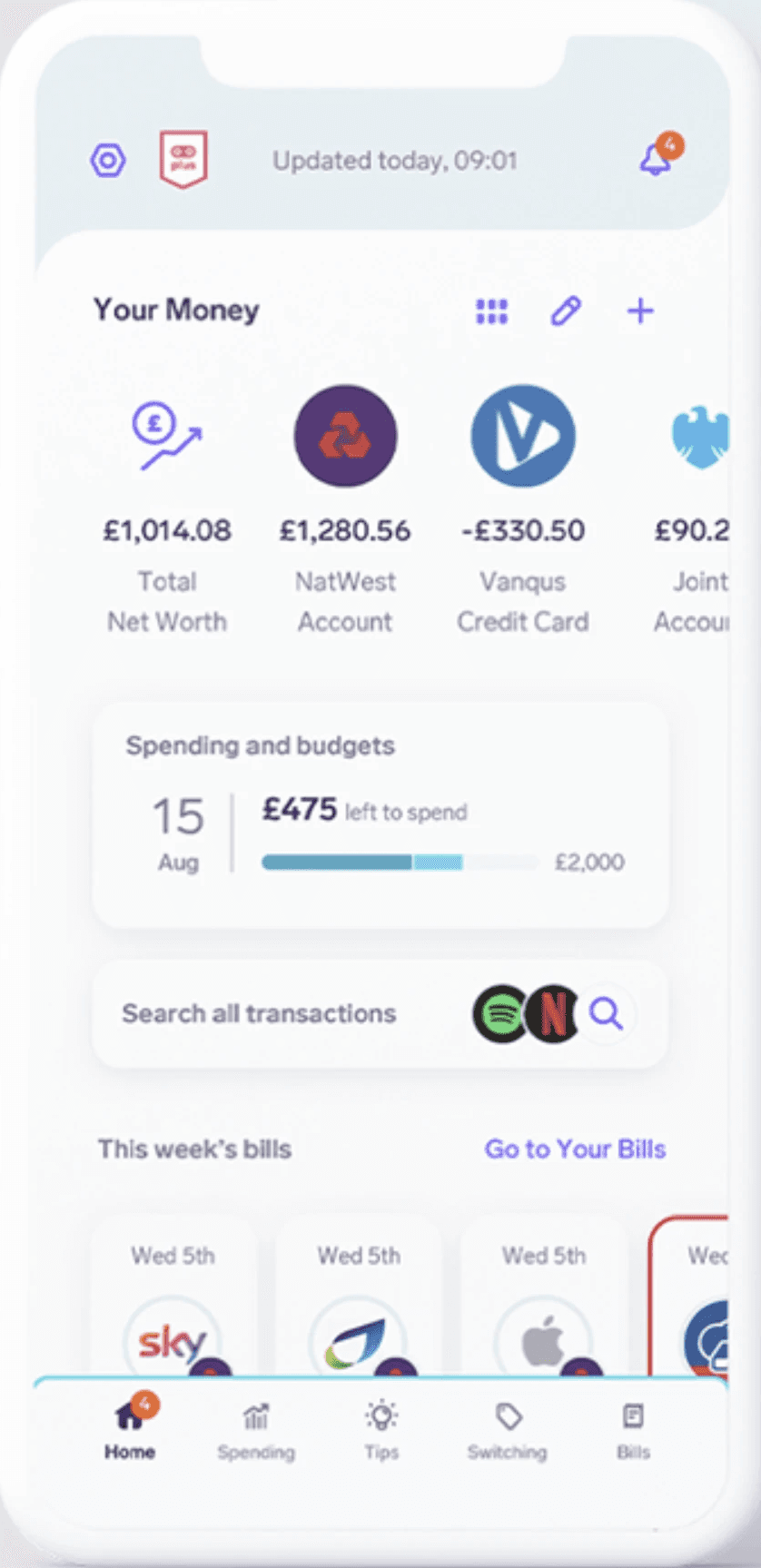

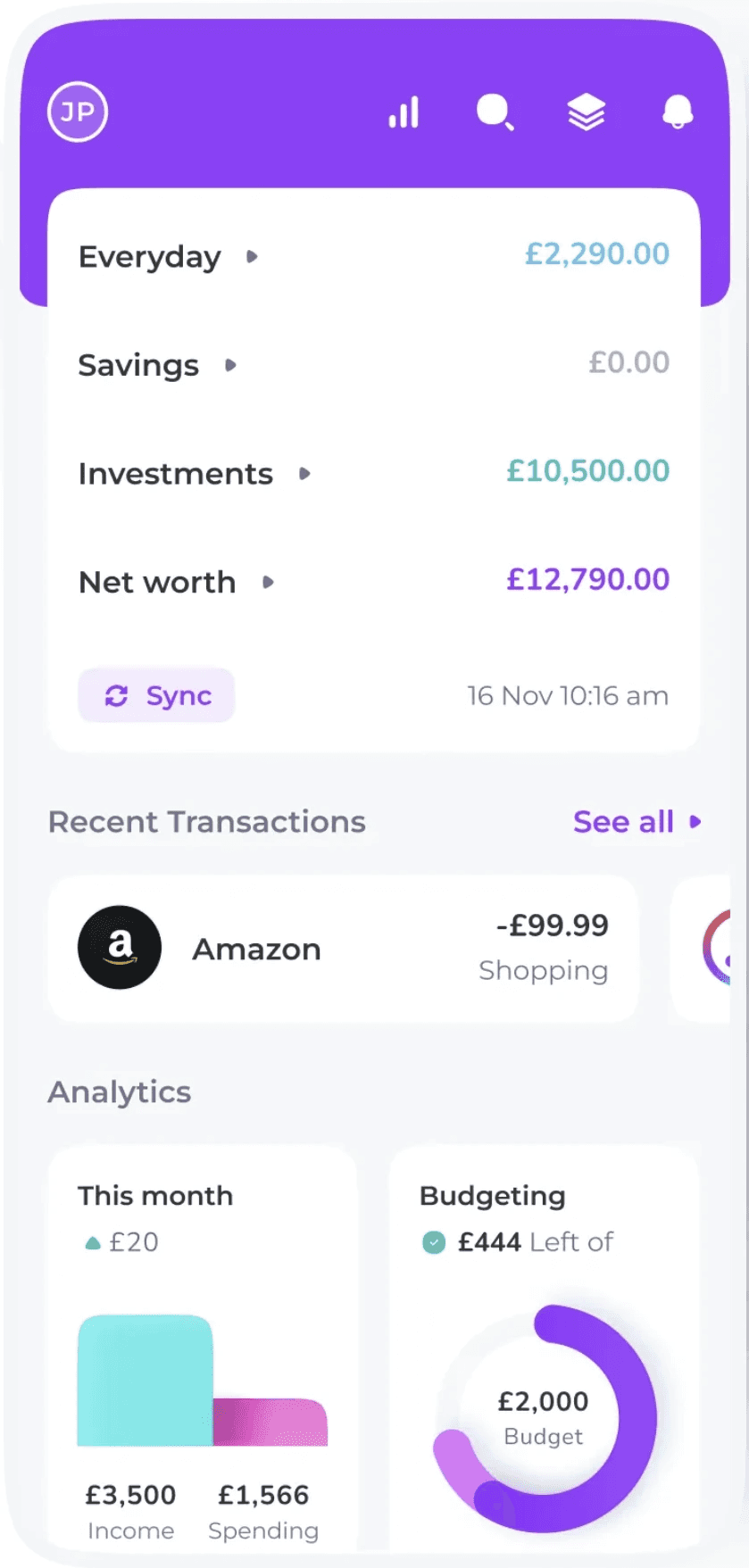

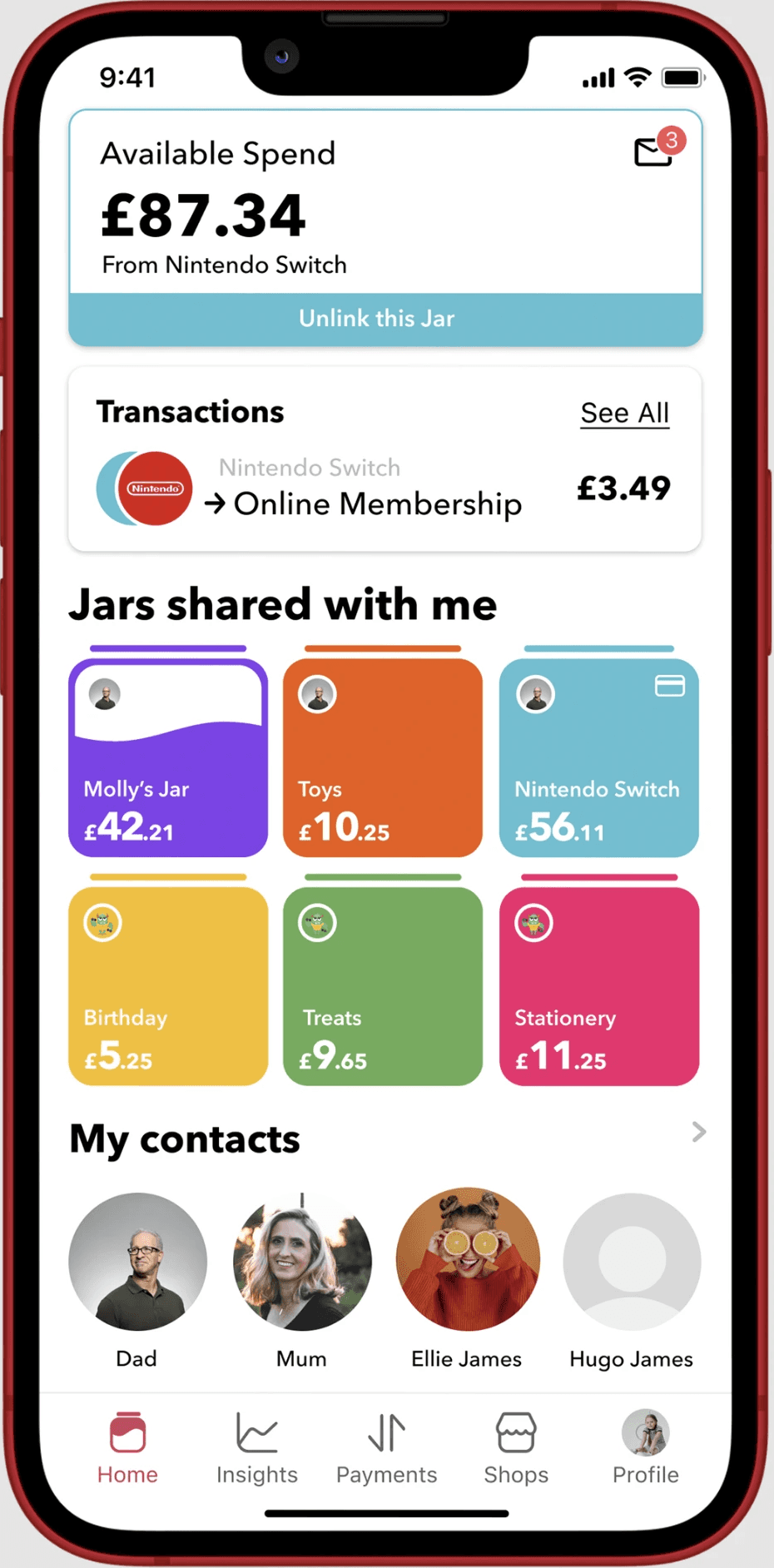

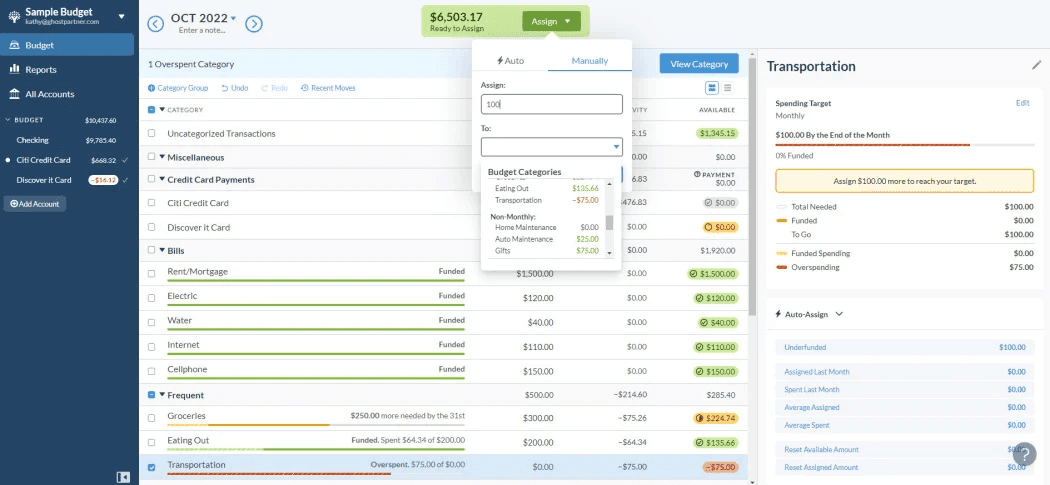

The budget app market is highly competitive, populated with a vast assortment of products. They range from basic calculation tools to sophisticated mobile applications brimming with numerous features. There are even advanced desktop tools like 'YNAB' with a focus on financial education.

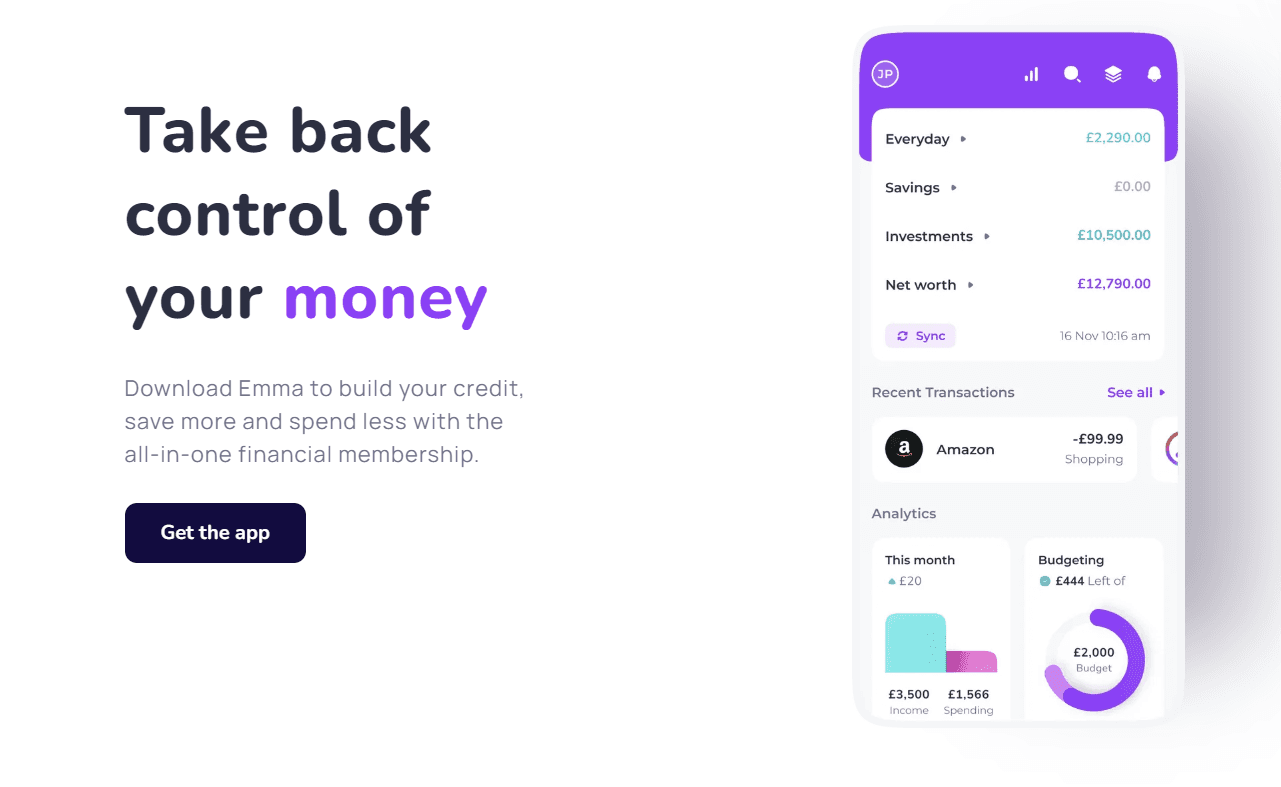

Market leading apps such as 'Emma' have beautiful UX and focus on everyday spending and budget setting.

You need a budget (YNAB) is one of the only desktop offerings with more advanced features.

'Emma' markets itself with the opening line 'Take back control of your money' implying that most people don't feel in control when it comes to their finances. They tap into the emotional side of the problem, that feeling of uncertainty from not knowing and lacking the visibility on financial decision making.

🤔

This speaks to the common problems people face:

How much am I spending each month?

What am I spending money on?

When will larger periodic bills hit throughout the year (e.g insurance, MOT)

How long until I can afford the deposit on a house?

Where can I make savings in my spending patterns?

How can I stay motivated to stick to savings goals?

How much should I be putting in my pension?

👇

The common solutions that the competition come up with typically look like this:

Aggregation of all bank account and savings accounts in one place to show net value

Categorised expense buckets

Budget or target setting around categories

Savings goals, sometimes with gamification features

Analytics and goal tracking

Transaction feed

These problems have clearly been well understood and explored by the competition already.

💡

My idea for innovating in this space was to focus on:

Longer term financial horizons, not just the short term picture

Scenario modelling to help demonstrate the impact of today's decisions on the future

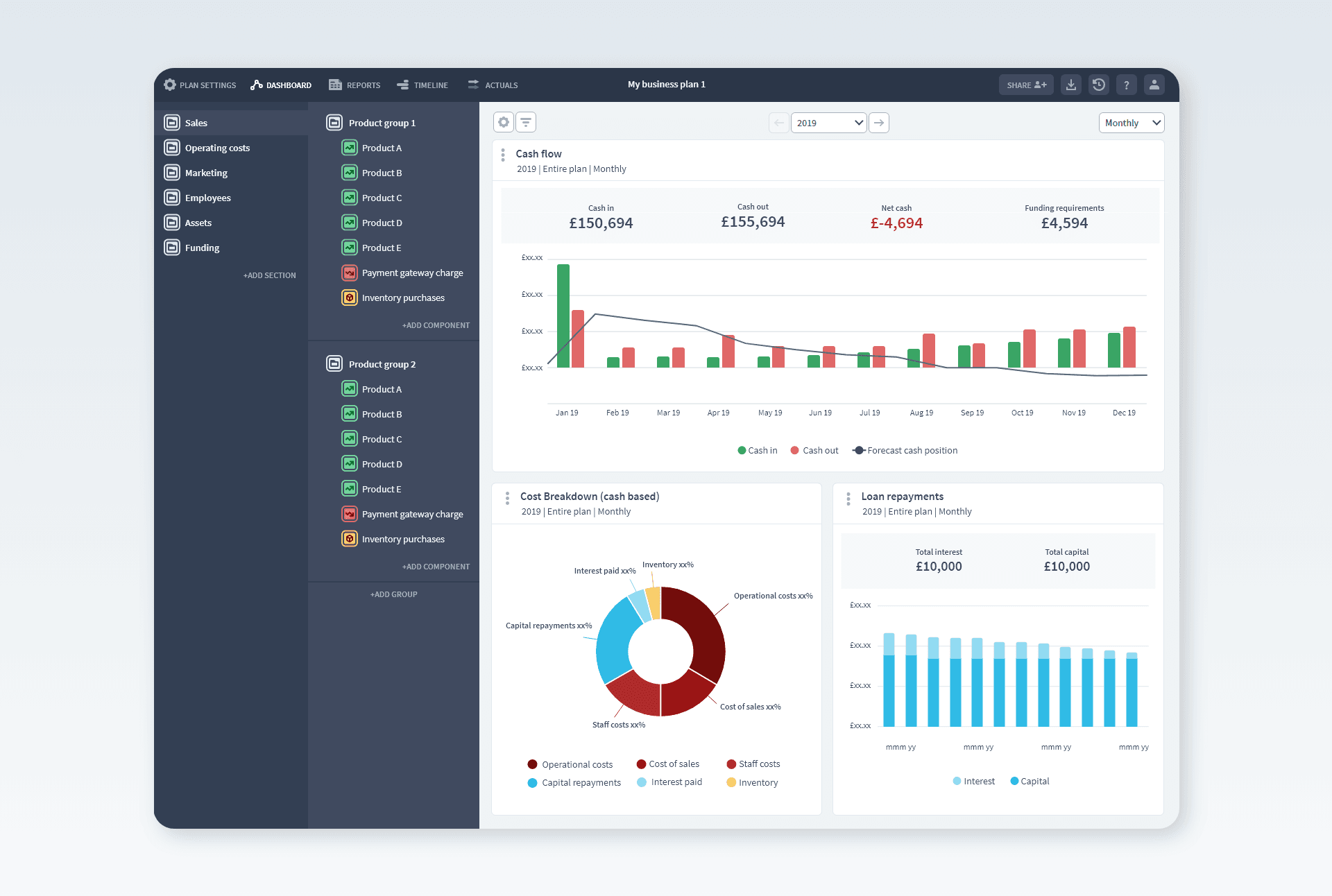

Financial modelling is common place in business planning for good reason. It's usually attached to business investment and funding. You need to demonstrate that you can budget responsibility and have a credible plan for growth.

My hypothesis is that it's just as a valuable for individuals but it's just not very accessible or easy to understand. That's what I want to fix.

Ideation

In sketching solutions, I wanted to design an app where the long term impact was front and centre. It also still needed to capture the core features that other apps have around budgets, categories and savings accounts.

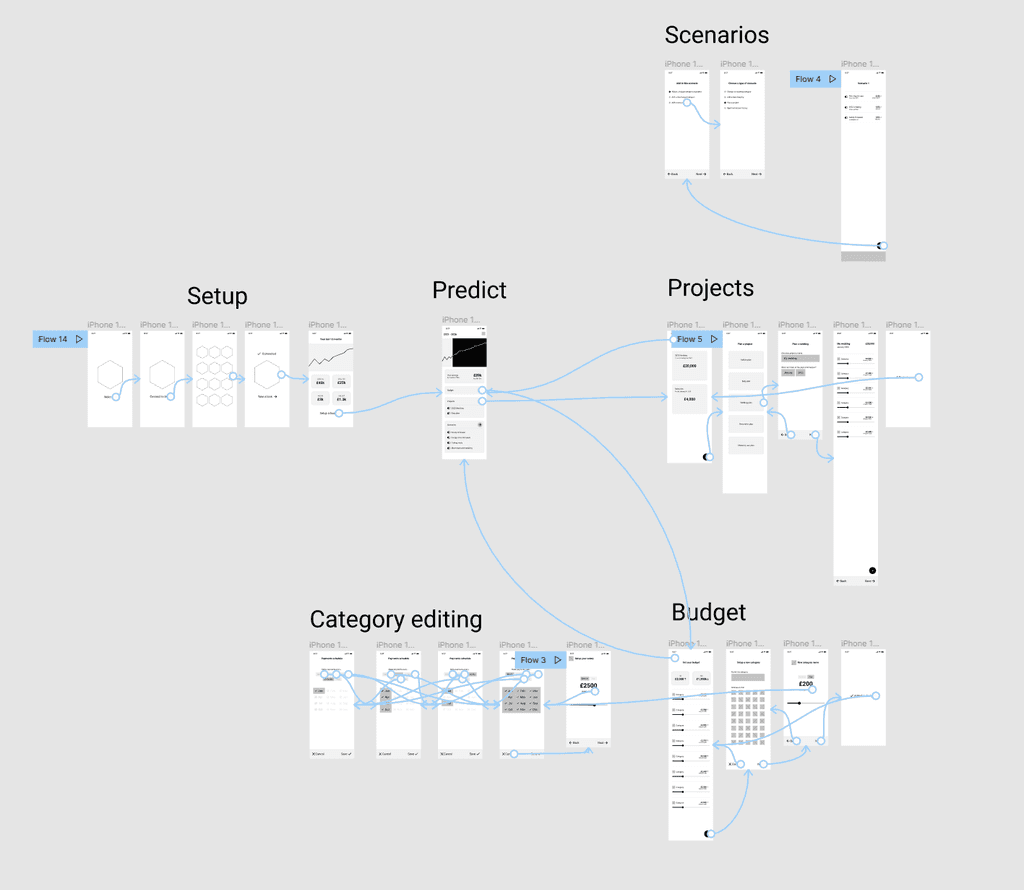

I came up with 3 pillars:

1) Budgets: Your monthly spend categories and targets

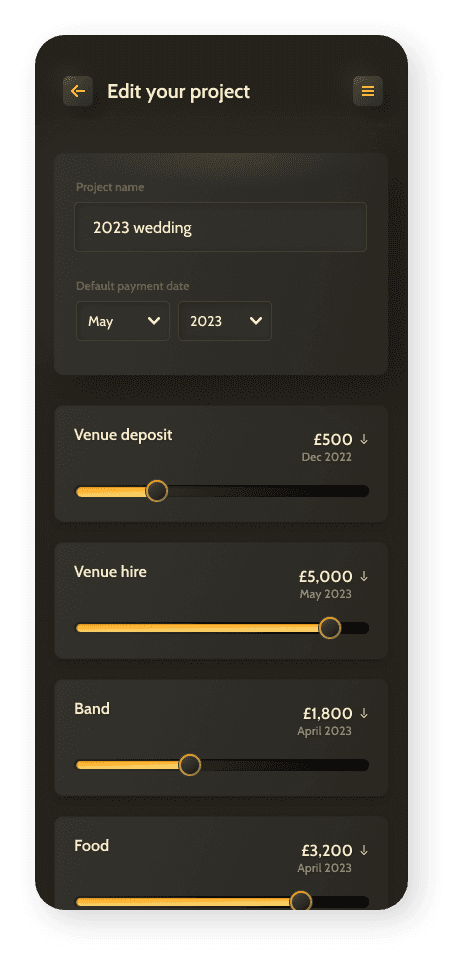

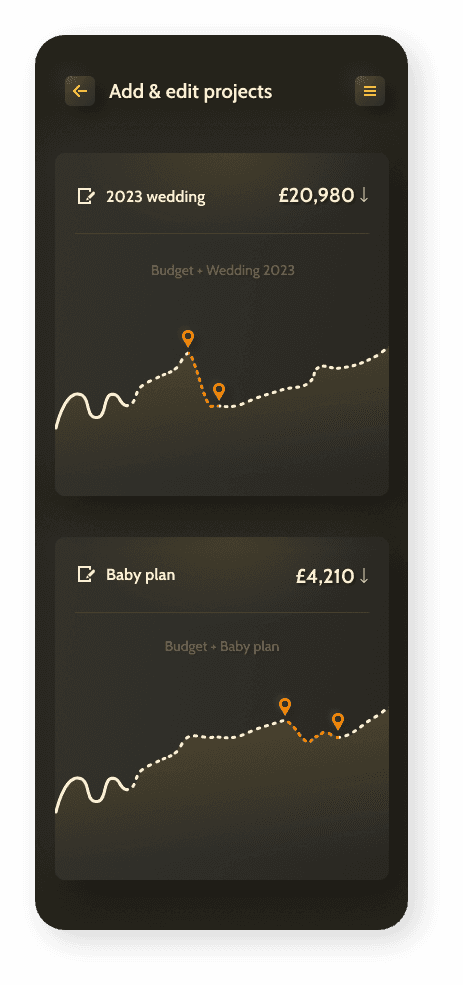

2) Projects: Big life events or one-off projects like a wedding, extension, holiday etc

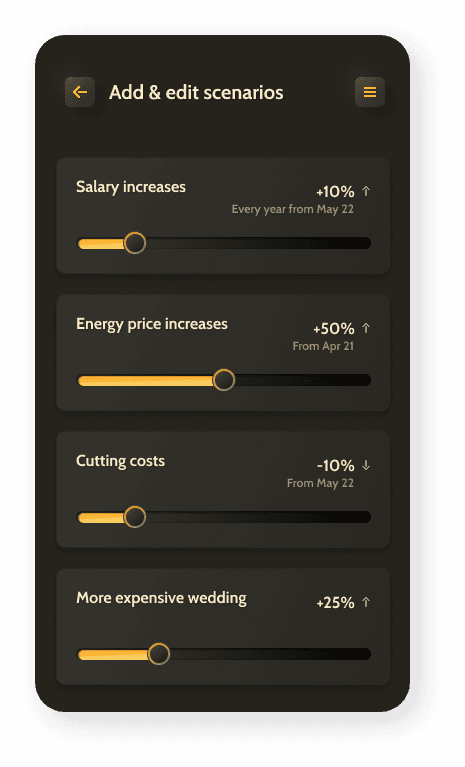

3) Scenarios: create scenarios that will modify your basic projections. E.g price inflation, salary increases, unexpected costs

This would give you a financial 'model' to play with. You could turn on/off different combinations of projects and scenarios to see the impact on your long term financial health.

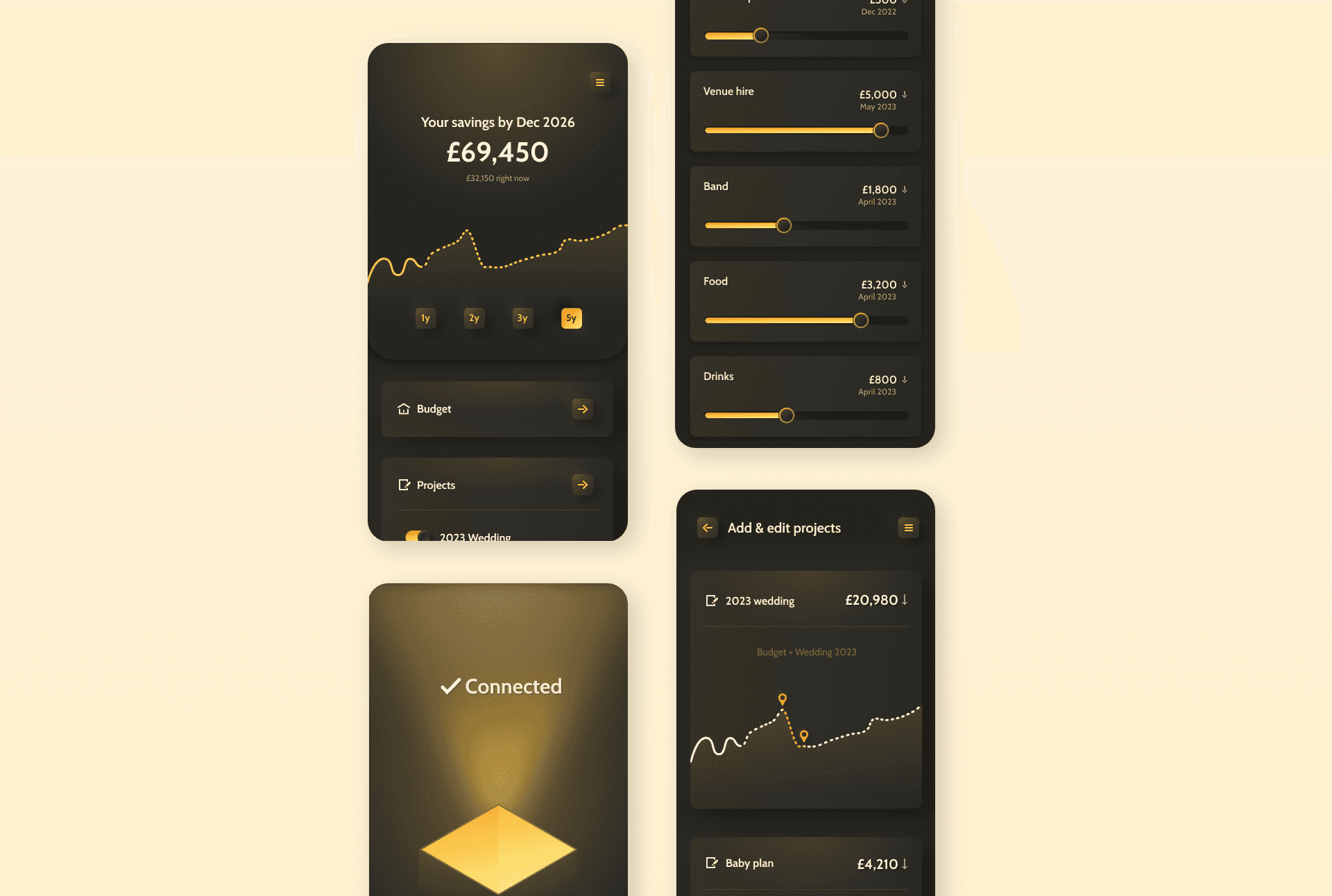

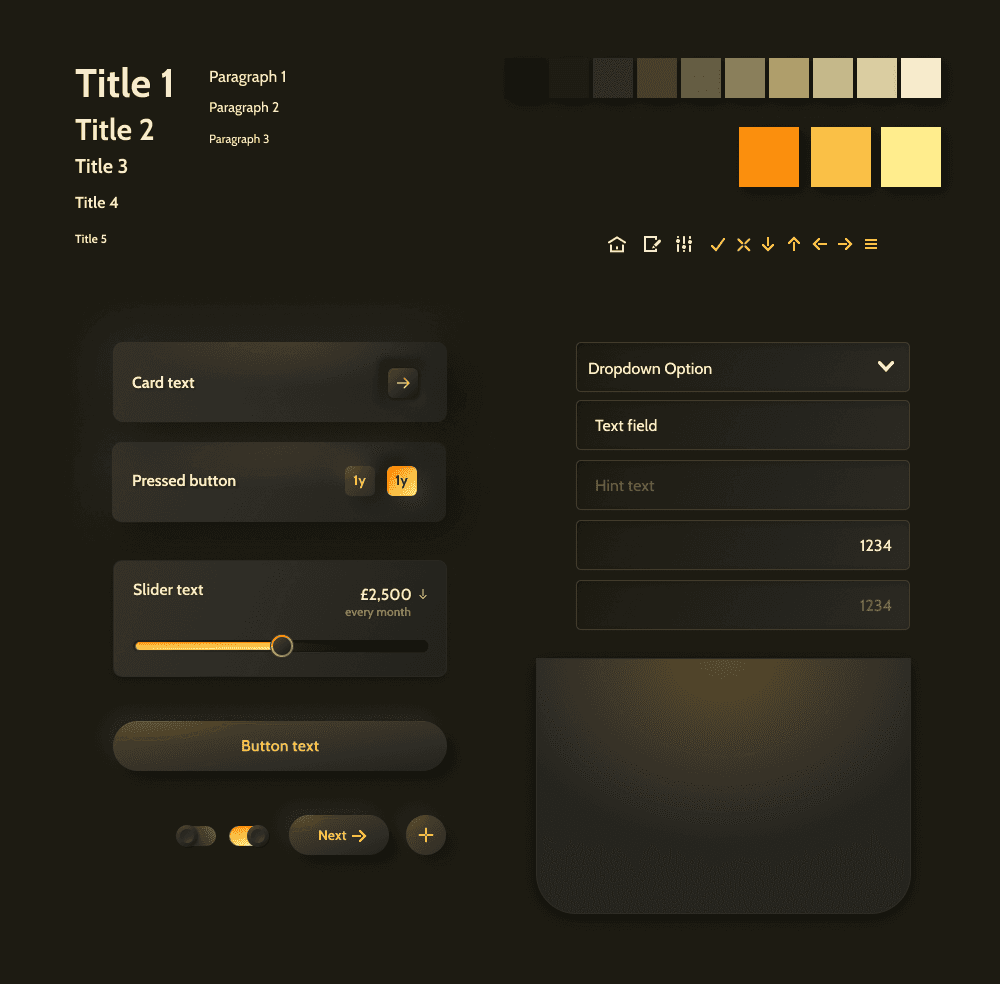

Visual design

I chose an experimental design system that plays with a warm light cast across the UI elements. I was interested in the visual metaphor of the dark uncertainty of the future which would be illuminated by using this app.

Getting started

The first step in the app is to connect to your bank and authorise your bank account. This retrieves historical data to build an initial financial picture.

The visual theme running through the app is the idea of unpacking the black box that hides your future. Opening this box provides illumination which is pushed through into all the UI elements.

To onboard consumers, the initial bank connection is visualised showing what happened in the last 12 months. A simple projection is made to show the next 12 months if the same trend continues. Then, to introduce some of the concepts in the app, a simple scenario is overlaid showing an increase in costs and the impact on savings.

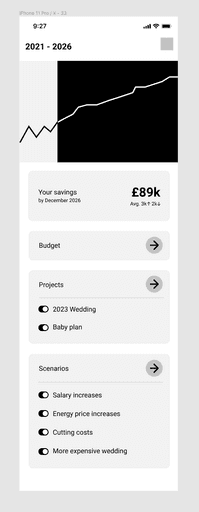

Homepage screen

The top chart shows your past year of financials and a projection of the future based on your budget, projects and scenarios. The home page acts as a launchpad for these 3 contributors.

Quick projections

The home page also allows you to quickly toggle between the projects and scenarios you've set up. It shows the impact on your savings at the top. You can zoom in an out with the preset timeframes.

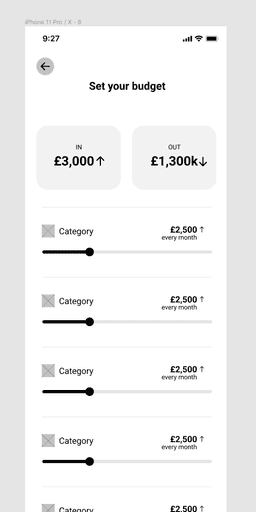

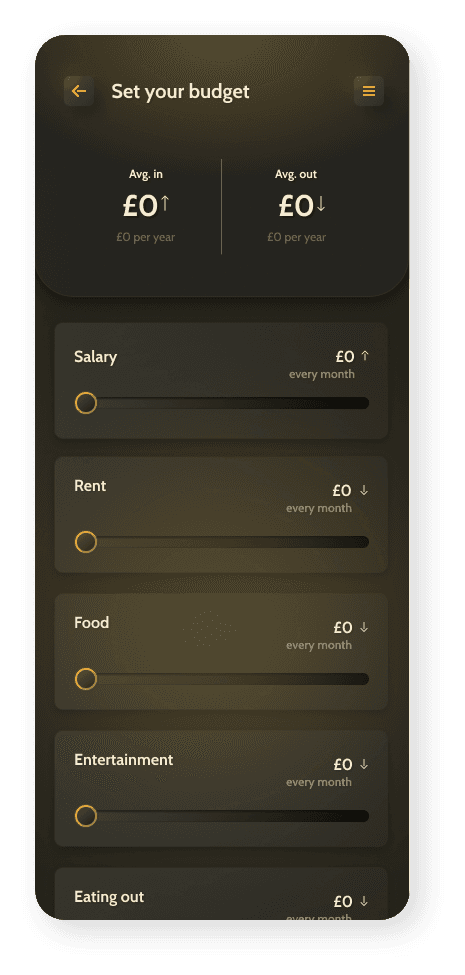

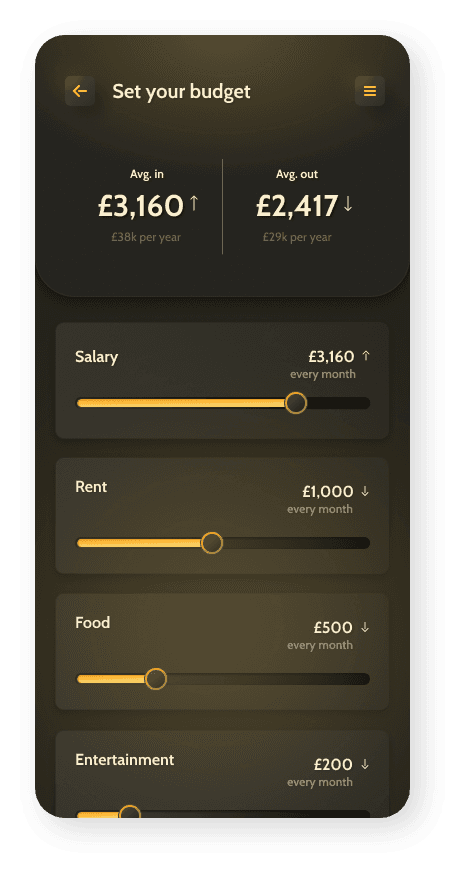

The budget creation screen

The budget screen allows users to quickly setup categories and adjust their budget allowance with sliders. There might be default categories that users could edit or add to.

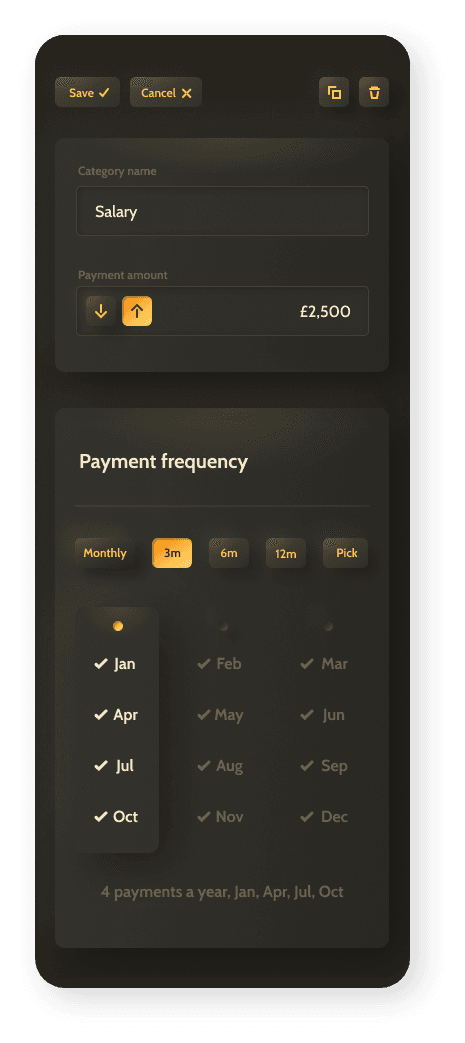

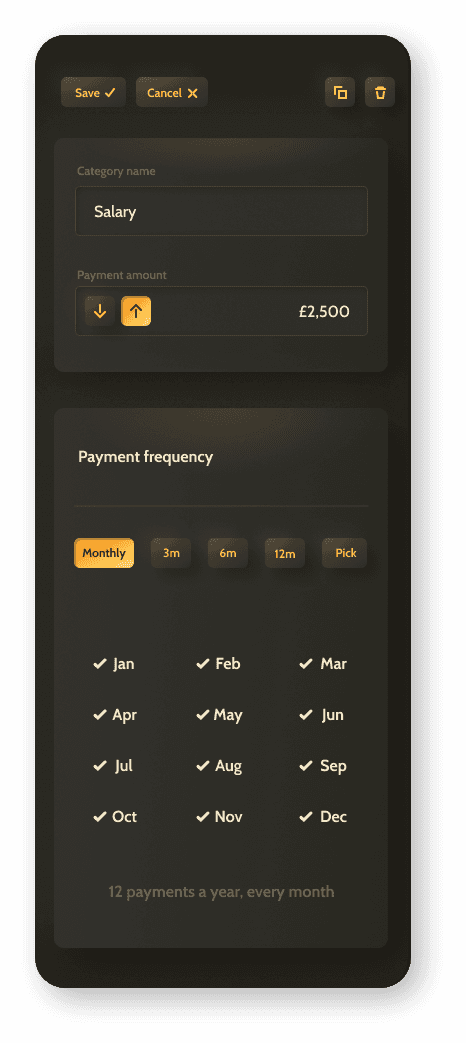

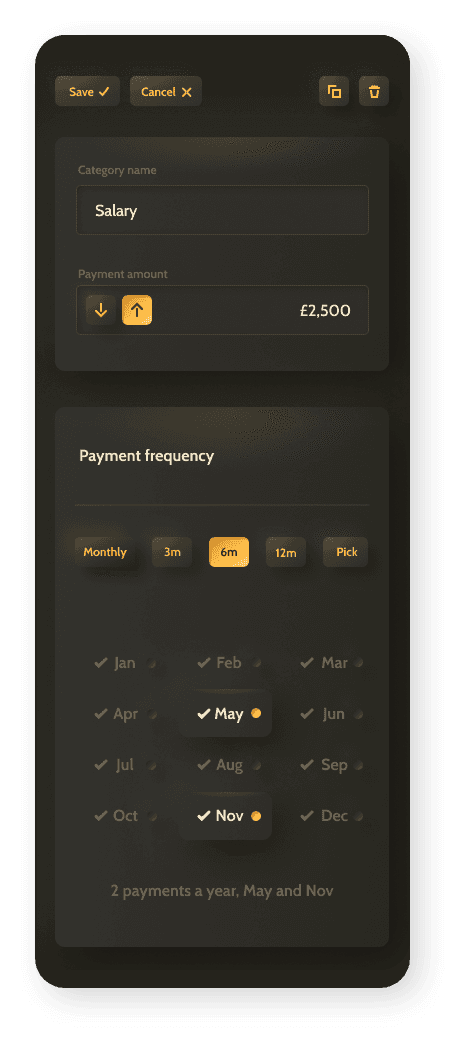

Setting payment forecast frequency

Editing a category provides more detailed options. A payment calendar allows users to control how often through the year payments are made.

Projects & scenarios

Projects allow users to collect an array of one-off costs that would be associated with an event like a wedding or a renovation. The impact would be visualised in a graph for each project. The orange markers show the project start and end date indicating the area where the project is effecting your finances and the future projection of that impact.

Next steps

I'd like to expand this concept to cover some more of the features that the competitors serve well. If the app had further features around short term budgeting, visualisation and goal setting it could be the best of both worlds giving you the long term picture as well as the short term steps and goals that take you there.